RV Sales Tax: What You Need to Know

Understanding RV Sales Tax A Comprehensive Guide

So, you're dreaming of hitting the open road in your very own RV? That's fantastic! The freedom, the adventure, the ability to wake up to a new view every day – it's an incredible lifestyle. But before you hand over your hard-earned cash and drive off into the sunset, there's a crucial topic you need to understand: RV sales tax. It's not the most glamorous part of RV ownership, but it's a necessary one. Ignoring it can lead to some unpleasant surprises down the road. This comprehensive guide will walk you through everything you need to know about RV sales tax, from the basics to some more complex scenarios. We'll cover what it is, how it's calculated, and how you can potentially save money on it. Buckle up, and let's dive in!

What Exactly is RV Sales Tax?

At its core, RV sales tax is a consumption tax levied by state and local governments on the purchase of a recreational vehicle. Think of it like the tax you pay when you buy clothes, electronics, or pretty much anything else at a retail store. The rate varies widely depending on where you make the purchase. Some states have no sales tax at all, while others have rates that can climb quite high. It's important to note that RV sales tax is typically a one-time payment, due at the time of purchase. However, you may also be subject to annual registration fees and property taxes depending on your state's regulations.

RV Sales Tax Rates State by State A Detailed Overview

As mentioned, RV sales tax rates vary significantly from state to state. This is where things can get a little tricky, so it's essential to do your research. Here's a general overview of some states with their RV sales tax rates. Keep in mind that these rates are subject to change, so always double-check with the relevant state authorities for the most up-to-date information.

- Alaska: No statewide sales tax. However, local municipalities may impose their own sales taxes.

- Delaware: No sales tax.

- Montana: No sales tax.

- New Hampshire: No sales tax.

- Oregon: No sales tax.

- Alabama: State sales tax rate is 4%. Local rates can add to this.

- Arizona: State sales tax rate is 5.6%. Local rates can add to this.

- Arkansas: State sales tax rate is 6.5%. Local rates can add to this.

- California: State sales tax rate is 7.25%. Local rates can add to this.

- Colorado: State sales tax rate is 2.9%. Local rates can add to this.

- Connecticut: State sales tax rate is 6.35%.

- Florida: State sales tax rate is 6%. Local rates can add to this.

- Georgia: State sales tax rate is 4%. Local rates can add to this.

- Hawaii: State sales tax rate is 4%.

- Idaho: State sales tax rate is 6%. Local rates can add to this.

- Illinois: State sales tax rate is 6.25%. Local rates can add to this.

- Indiana: State sales tax rate is 7%.

- Iowa: State sales tax rate is 6%. Local rates can add to this.

- Kansas: State sales tax rate is 6.5%. Local rates can add to this.

- Kentucky: State sales tax rate is 6%.

- Louisiana: State sales tax rate is 4.45%. Local rates can add to this.

- Maine: State sales tax rate is 5.5%.

- Maryland: State sales tax rate is 6%.

- Massachusetts: State sales tax rate is 6.25%.

- Michigan: State sales tax rate is 6%.

- Minnesota: State sales tax rate is 6.875%. Local rates can add to this.

- Mississippi: State sales tax rate is 7%. Local rates can add to this.

- Missouri: State sales tax rate is 4.225%. Local rates can add to this.

- Nebraska: State sales tax rate is 5.5%. Local rates can add to this.

- Nevada: State sales tax rate is 6.85%. Local rates can add to this.

- New Jersey: State sales tax rate is 6.625%. Some areas have reduced rates.

- New Mexico: State sales tax rate is 5.125%. Local rates can add to this.

- New York: State sales tax rate is 4%. Local rates can add to this.

- North Carolina: State sales tax rate is 4.75%. Local rates can add to this.

- North Dakota: State sales tax rate is 5%. Local rates can add to this.

- Ohio: State sales tax rate is 5.75%. Local rates can add to this.

- Oklahoma: State sales tax rate is 4.5%. Local rates can add to this.

- Pennsylvania: State sales tax rate is 6%. Local rates can add to this.

- Rhode Island: State sales tax rate is 7%.

- South Carolina: State sales tax rate is 6%. Local rates can add to this.

- South Dakota: State sales tax rate is 4.5%. Local rates can add to this.

- Tennessee: State sales tax rate is 7%. Local rates can add to this.

- Texas: State sales tax rate is 6.25%. Local rates can add to this.

- Utah: State sales tax rate is 6.1%. Local rates can add to this.

- Vermont: State sales tax rate is 6%.

- Virginia: State sales tax rate is 5.3%. An additional 1% regional tax may apply in Northern Virginia and Hampton Roads.

- Washington: State sales tax rate is 6.5%. Local rates can add to this.

- West Virginia: State sales tax rate is 6%.

- Wisconsin: State sales tax rate is 5%. Local rates can add to this.

- Wyoming: State sales tax rate is 4%. Local rates can add to this.

Important Note: Always verify the specific sales tax rate with the dealership and your state's Department of Revenue. Local sales taxes can significantly impact the final price.

Calculating RV Sales Tax Understanding the Process

The calculation of RV sales tax is relatively straightforward. It's simply the sales price of the RV multiplied by the applicable sales tax rate. However, there are a few factors that can complicate things. Let's break it down:

Basic Calculation:

Sales Tax = RV Price x Sales Tax Rate

Example:

You purchase an RV for $50,000 in a state with a 6% sales tax rate.

Sales Tax = $50,000 x 0.06 = $3,000

Your total cost, including sales tax, would be $53,000.

Factors That Can Affect the Calculation:

- Trade-Ins: Many states allow you to deduct the value of a trade-in vehicle from the price of the new RV before calculating sales tax. This can save you a significant amount of money. For example, if you trade in a car worth $10,000 towards the $50,000 RV, you would only pay sales tax on $40,000.

- Rebates: Similar to trade-ins, some states allow you to deduct manufacturer rebates from the taxable price of the RV.

- Out-of-State Purchases: If you purchase an RV in one state but register it in another, you may be subject to the sales tax rate of the state where you register it. This is a complex area, and it's best to consult with a tax professional or the relevant state authorities.

- Fees and Add-ons: Some fees and add-ons, such as transportation fees or extended warranties, may be subject to sales tax, while others may not. Check with the dealership to understand which items are taxable.

Strategies for Saving Money on RV Sales Tax Exploring Options

Nobody likes paying taxes, so it's natural to look for ways to minimize your RV sales tax burden. Here are a few strategies to consider:

- Consider Purchasing in a State with Lower or No Sales Tax: This is the most obvious strategy. If you live near a state with a lower sales tax rate, or even no sales tax, it may be worth the trip to purchase your RV there. However, be sure to factor in the cost of travel, accommodation, and any potential registration fees in your home state. Also, be aware of "use tax," which some states levy on items purchased out of state but used within the state.

- Take Advantage of Trade-In Credits: If you have a vehicle to trade in, make sure the dealership offers you a fair price and that the trade-in value is properly deducted from the taxable price of the RV.

- Negotiate the Price: The lower the price of the RV, the lower your sales tax will be. Don't be afraid to negotiate with the dealership to get the best possible deal.

- Look for Rebates and Incentives: Check with the manufacturer and the dealership for any available rebates or incentives that can reduce the purchase price.

- Consult with a Tax Professional: A tax professional can provide personalized advice based on your specific circumstances and help you identify any potential tax savings opportunities.

RV Sales Tax and Residency Establishing Your Home Base

Your residency plays a significant role in determining which state's sales tax laws apply to your RV purchase. Establishing residency can be complex, especially for full-time RVers who may not have a traditional home. Here are some factors to consider:

- Driver's License: Your driver's license is often used as proof of residency.

- Vehicle Registration: Registering your vehicles in a particular state is another indicator of residency.

- Voter Registration: Registering to vote in a state demonstrates your intent to reside there.

- Bank Accounts: Opening bank accounts in a state can also help establish residency.

- Physical Address: Having a physical address in a state, even if it's a mail forwarding service, can be beneficial.

- State Income Tax: Paying state income tax in a particular state is a strong indicator of residency.

It's crucial to understand the residency requirements of each state you're considering and to comply with those requirements to avoid any legal or tax issues. This is especially important for full-time RVers who may be traveling across state lines frequently.

Understanding Use Tax and Its Implications for RV Owners

Even if you purchase your RV in a state with no sales tax, you may still be subject to "use tax" in your home state. Use tax is a tax levied on goods purchased outside of a state but used within that state. The purpose of use tax is to prevent residents from avoiding sales tax by purchasing goods in other states. The rate is generally the same as the sales tax rate in your state.

How Use Tax Works:

Let's say you live in California, which has a high sales tax rate. You decide to purchase an RV in Oregon, which has no sales tax. When you bring the RV back to California and register it, you will likely be required to pay use tax on the purchase price. The use tax rate will be the same as California's sales tax rate.

Avoiding Use Tax:

In some cases, you may be able to avoid use tax if you can demonstrate that you paid sales tax on the RV in another state. However, the amount of the sales tax paid must be equal to or greater than the use tax that would be due in your home state. If the sales tax paid in the other state is less than the use tax, you may be required to pay the difference.

Enforcement of Use Tax:

States are increasingly cracking down on use tax evasion. They may use various methods to identify residents who have purchased goods out of state, such as cross-referencing vehicle registration data with sales tax records. Failure to pay use tax can result in penalties and interest charges.

RV Sales Tax Exemptions Who Qualifies and How to Apply

In some cases, you may be eligible for an RV sales tax exemption. These exemptions typically apply to specific types of buyers or situations. Here are a few examples:

- Non-Profit Organizations: Some states offer sales tax exemptions to non-profit organizations that purchase RVs for charitable purposes.

- Government Entities: Government entities, such as schools and law enforcement agencies, may also be exempt from sales tax.

- Out-of-State Buyers: As mentioned earlier, if you are an out-of-state buyer and you will be taking the RV out of the state immediately after purchase, you may be exempt from sales tax.

- Disabled Veterans: Some states offer sales tax exemptions or reduced rates to disabled veterans.

To claim a sales tax exemption, you will typically need to provide documentation to the dealership or the state's Department of Revenue. The specific requirements vary depending on the state and the type of exemption. It's essential to research the requirements carefully and to gather all the necessary documentation before making your purchase.

Financing Your RV and its Impact on Sales Tax Considerations

Financing your RV can have an indirect impact on your sales tax considerations. Here's how:

- Higher Purchase Price: When you finance an RV, you will typically pay interest on the loan. This increases the overall cost of the RV, but it does not affect the amount of sales tax you pay. Sales tax is calculated based on the initial purchase price of the RV, not the total amount you pay over the life of the loan.

- Down Payment: The amount of your down payment does not affect the amount of sales tax you pay. Sales tax is calculated on the full purchase price of the RV, regardless of how much you put down.

- Loan Terms: The length of your loan term does not affect the amount of sales tax you pay. Sales tax is a one-time payment due at the time of purchase.

While financing doesn't directly impact sales tax, it's important to consider the overall cost of financing when budgeting for your RV purchase. Be sure to compare interest rates and loan terms from different lenders to find the best deal.

RV Sales Tax Audits What to Expect and How to Prepare

While less common than income tax audits, RV sales tax audits can occur. If you are selected for an audit, it's important to understand what to expect and how to prepare. Here's a general overview:

Notification: You will typically receive a written notification from the state's Department of Revenue informing you of the audit.

Scope of the Audit: The audit will typically focus on your RV purchase and whether you paid the correct amount of sales tax. The auditor may request documentation such as your purchase agreement, financing documents, registration information, and proof of residency.

Documentation: It's crucial to keep accurate records of your RV purchase and any related expenses. This will help you support your claim that you paid the correct amount of sales tax.

Cooperation: Cooperate fully with the auditor and provide them with all the requested documentation in a timely manner.

Representation: You have the right to be represented by an attorney or a tax professional during the audit.

Potential Outcomes: If the auditor determines that you underpaid sales tax, you will be required to pay the difference, plus penalties and interest. If the auditor determines that you overpaid sales tax, you may be entitled to a refund.

Preventing Audits: The best way to avoid an RV sales tax audit is to ensure that you pay the correct amount of sales tax in the first place. Consult with a tax professional or the state's Department of Revenue if you have any questions or concerns.

RV Sales Tax and Full-Time RV Living Navigating the Complexities

Full-time RV living presents unique challenges when it comes to RV sales tax. Because you are constantly traveling, it can be difficult to establish residency and determine which state's sales tax laws apply to your purchase. Here are some tips for navigating these complexities:

- Establish a Domicile: Choose a state to establish as your domicile. This is your legal home and the state where you intend to reside permanently.

- Comply with Residency Requirements: Comply with the residency requirements of your chosen domicile state, such as obtaining a driver's license, registering your vehicles, and registering to vote.

- Consider the Sales Tax Rate: Choose a domicile state with a low or no sales tax rate to minimize your tax burden.

- Be Aware of Use Tax: Be aware of the use tax laws in the states where you spend most of your time.

- Consult with a Tax Professional: Consult with a tax professional who specializes in RV taxes to get personalized advice based on your specific circumstances.

Choosing the right domicile state is a crucial decision for full-time RVers. It can have a significant impact on your taxes, insurance, and other legal matters. Do your research carefully and choose a state that aligns with your lifestyle and financial goals.

Used RV Sales Tax Considerations and Potential Savings

Purchasing a used RV can offer significant savings, and that extends to sales tax as well. Here's how sales tax considerations differ for used RVs:

- Taxable Price: The sales tax is calculated on the selling price of the used RV. This is often lower than the price of a new RV, resulting in lower sales tax.

- Trade-Ins: Trade-in credits typically apply to used RV purchases as well, further reducing the taxable price.

- Private Sales: In some states, private sales of used RVs may be exempt from sales tax. However, this is not always the case, so it's essential to check with your state's Department of Revenue.

- Negotiation: Don't hesitate to negotiate the price of a used RV to potentially lower the sales tax.

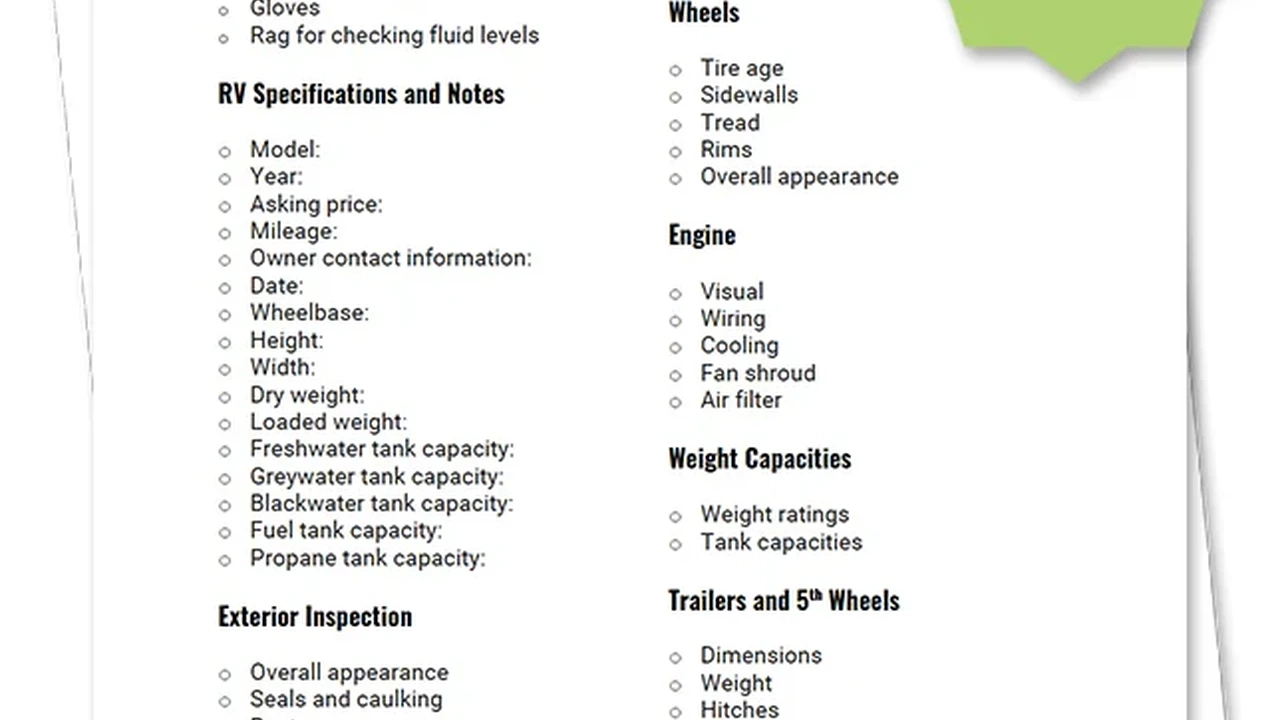

When purchasing a used RV, be sure to inspect it thoroughly and have it checked out by a qualified mechanic. This will help you avoid any unexpected repairs that could offset the savings you achieve on sales tax.

RV Sales Tax and Online Purchases Navigating the Digital Landscape

The rise of online RV sales has added another layer of complexity to the RV sales tax landscape. Here's what you need to know about RV sales tax and online purchases:

- Nexus: If the online RV dealer has a physical presence in your state, they are typically required to collect sales tax from you. This is known as having "nexus" in your state.

- Marketplace Facilitator Laws: Many states have enacted marketplace facilitator laws that require online marketplaces, such as eBay or Amazon, to collect sales tax on behalf of third-party sellers.

- Use Tax: Even if the online RV dealer does not collect sales tax from you, you may still be subject to use tax in your home state.

- Shipping and Handling: Shipping and handling charges may be subject to sales tax, depending on the state.

When purchasing an RV online, be sure to clarify with the seller whether they are required to collect sales tax from you. If they are not, be prepared to pay use tax in your home state.

RV Sales Tax Across State Lines Understanding Interstate Transactions

Purchasing an RV across state lines can be a tricky proposition when it comes to sales tax. Here's a breakdown of what you need to know:

- Point of Sale: Generally, sales tax is based on the point of sale, meaning the location where you take possession of the RV.

- Reciprocity Agreements: Some states have reciprocity agreements with each other, which may affect how sales tax is collected.

- Use Tax: As mentioned earlier, you may be subject to use tax in your home state even if you pay sales tax in another state.

- Documentation: Keep accurate records of your purchase and any sales tax you pay in another state. This will help you avoid being double-taxed.

Before purchasing an RV across state lines, it's essential to consult with a tax professional or the relevant state authorities to understand the sales tax implications.

RV Sales Tax and International Purchases Considerations for Importing

Importing an RV from another country adds even more complexity to the sales tax equation. Here are some considerations for international RV purchases:

- Customs Duties: In addition to sales tax, you will likely be required to pay customs duties on the imported RV.

- Import Regulations: You will need to comply with all applicable import regulations, including safety and emissions standards.

- Sales Tax: The sales tax rate will depend on the state where you register the RV.

- Documentation: You will need to provide documentation such as the bill of sale, the title, and the import paperwork.

Importing an RV can be a complex and expensive process. It's essential to do your research carefully and to consult with a customs broker or a tax professional to ensure that you comply with all applicable laws and regulations.

Navigating RV Sales Tax Resources and Expert Advice

Navigating the complexities of RV sales tax can be challenging. Fortunately, there are many resources available to help you. Here are a few:

- State Departments of Revenue: Each state's Department of Revenue website provides information on sales tax laws and regulations.

- Tax Professionals: A tax professional who specializes in RV taxes can provide personalized advice based on your specific circumstances.

- RV Dealers: RV dealers can provide information on sales tax rates and how they are calculated.

- Online Forums: Online forums and communities dedicated to RVing can be a valuable source of information and support.

Don't hesitate to seek out expert advice when making your RV purchase. A little research can save you a lot of money and headaches in the long run.

RV Sales Tax: Specific Product Recommendations

While I can't endorse specific brands due to objectivity, I can suggest the types of products that can help reduce your overall taxable amount or make the process easier.

Solar Panels

Use Case: Installing solar panels on your RV can reduce your reliance on campground hookups, saving you money on electricity costs in the long run. While the initial investment can be significant, some states offer tax incentives or rebates for renewable energy installations, effectively reducing the cost.

Detailed Information: Solar panels come in various sizes and wattages. Consider your energy needs and the available space on your RV roof when selecting solar panels. Professional installation is recommended for optimal performance and safety.

Pricing: A complete solar panel system for an RV can range from $1,000 to $5,000, depending on the size and complexity of the system.

LED Lighting

Use Case: Switching to LED lighting throughout your RV is an energy-efficient upgrade that can reduce your electricity consumption. LEDs last much longer than traditional incandescent bulbs, saving you money on replacements.

Detailed Information: LEDs are available in various colors and brightness levels. Choose LEDs that are compatible with your RV's electrical system. LED bulbs also generate less heat, which can make your RV more comfortable in warm weather.

Pricing: LED bulbs are relatively inexpensive, ranging from $5 to $20 per bulb.

Water Filtration Systems

Use Case: A water filtration system can improve the quality of your drinking water and protect your RV's plumbing system from sediment and contaminants. This can save you money on bottled water and prevent costly repairs.

Detailed Information: Water filtration systems come in various types, including whole-house filters, under-sink filters, and portable filters. Choose a system that meets your specific needs and water quality concerns.

Pricing: Water filtration systems can range from $50 to $500, depending on the type and features of the system.

RV Covers

Use Case: Protecting your RV with a cover when it's not in use can help prevent damage from the elements, such as sun, rain, and snow. This can extend the life of your RV and reduce the need for repairs.

Detailed Information: RV covers are available in various sizes and materials. Choose a cover that is designed specifically for your RV's size and shape. Look for a cover that is breathable and waterproof.

Pricing: RV covers can range from $100 to $500, depending on the size and material.

Tire Pressure Monitoring Systems (TPMS)

Use Case: A TPMS can help you monitor your RV's tire pressure and temperature, preventing tire blowouts and improving fuel efficiency. This can save you money on tire replacements and fuel costs.

Detailed Information: TPMS systems come in various types, including internal and external sensors. Choose a system that is compatible with your RV's tires and wheels. Proper installation and calibration are essential for accurate readings.

Pricing: TPMS systems can range from $100 to $400, depending on the features and number of sensors.

RV Sales Tax Product Comparisons

Let's compare some similar products and how they affect your overall RV experience and potential savings (indirectly related to initial sales tax, but important for long-term cost of ownership).

Portable Generators vs. Solar Power Systems

Portable Generators: Relatively inexpensive upfront, provide reliable power, but require fuel (propane or gasoline), which adds to long-term costs. No tax incentives typically apply.

Solar Power Systems: More expensive upfront, but offer free and renewable energy. Some states offer tax credits or rebates for solar installations. Reduces reliance on paid campground hookups.

RV Covers: Different Materials

Polyester RV Covers: More affordable, lightweight, but less durable in extreme weather conditions.

Polypropylene RV Covers: More durable, waterproof, and breathable, but more expensive. Offers better protection and potentially extends the life of your RV, reducing future repair costs.

Water Filters: Different Types

Inline Water Filters: Simple and inexpensive, but offer limited filtration.

Whole-House Water Filters: More comprehensive filtration, protecting all water sources in your RV, but more expensive to install.

Remember, these are just examples. The best products for you will depend on your individual needs and budget. Always research and compare different options before making a purchase.Final Thoughts on RV Sales Tax

Navigating RV sales tax can seem daunting, but with a little research and planning, you can minimize your tax burden and enjoy the open road. Remember to consider factors such as state sales tax rates, trade-in credits, residency requirements, and use tax. Consult with a tax professional if you have any questions or concerns. Happy RVing!

:max_bytes(150000):strip_icc()/277019-baked-pork-chops-with-cream-of-mushroom-soup-DDMFS-beauty-4x3-BG-7505-5762b731cf30447d9cbbbbbf387beafa.jpg)